OCA Blog

April 5th, 2021 — In News & Events

Divided Wisconsin Supreme Court Upholds Highway’s Jurisdictional Offer in Controversial Case

We are disappointed in the recent decision by the Wisconsin Supreme Court upholding a pre-condemnation jurisdictional offer made by the Wisconsin Department of Transportation (DOT) to a property owner that deviated substantially from the Department’s own appraisal which, under Wisconsin law, is required to form the basis of the offer. As three Supreme Court Justices (including the Chief Justice) correctly pointed out in their strong dissent, the jurisdictional offer...

Read More

April 5th, 2021 — In OCA Blog

ALI-CLE Eminent Domain and Land Valuation Litigation Conference Now Scheduled for 2022

Mark your calendars for the next ALI-CLE Eminent Domain and Land Valuation Litigation Conference to be held in Scottsdale, Arizona at the Scottsdale Resort at McCormick Ranch. The conference dates are January 27-29, 2022. Exploring a full range of cutting-edge issues and drawing professionals from across the country, this annual conference is always “the place to be” for all eminent domain and land use practitioners looking to learn from...

Read More

April 4th, 2021 — In News & Events

North Dakota Court Rules in Property Owner’s Favor in Pre-Condemnation Entry Claim by Condemnor

In the recent case entitled Cass County Joint Water Resource District, v. Cash H. Aaland, Larry W. Bakko and Penny Cirks, the North Dakota Supreme Court rules in the property owners favor on the issue of whether a Water District had the authority to enter upon the owner’s property prior to filing a condemnation case, as part of a flood diversion project. In this unique factual situation, the Water District...

Read More

March 23rd, 2021 — In News & Events

Cedar Point Nursery v. Hassid Oral Argument

The Supreme Court is currently entertaining an interesting property rights case entitled Cedar Point Nursery v. Hassid. Cedar Point Nursery together with Fowler Packing Company are California fruit growers that employ around 3,000 Californians. In 2015, the United Farm Workers (UFW) sent union organizers to Cedar Point’s workplace during harvest time to encourage them to unionize. Under California’s Union Access Regulation the organizers are granted an easement that allows them to...

Read More

March 3rd, 2021 — In OCA Blog

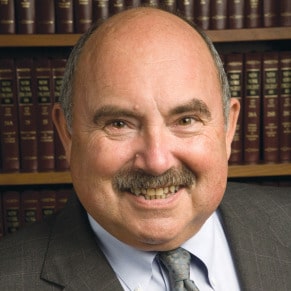

OCA Member Michael Rikon Inducted into IAOTP’s Hall of Fame

Michael Rikon, OCA’s New York Member and a Partner of Goldstein, Rikon, Rikon & Houghton, P.C., was recently inducted into the exclusive Hall of Fame for 2021 by the International Association of Top Professionals (IAOTP). These special honorees are distinguished based on longevity in their fields of practice, as well as their overall contributions to society. Mr. Rikon is being recognized for this honor based on over 50 years in the...

Read More

February 24th, 2021 — In News & Events

U.S. Supreme Court Refuses to Take Up Important Land Use and Takings Case out of Hawaii

A few days ago the U.S. Supreme Court in this order declined to issue a writ of certiorari to review the Ninth Circuit’s decision in Bridge Aina Lea, LLC v. Hawaii Land Use Comm’n, No. 20-54, a case in which a federal court jury concluded the property owner suffered both a Lucas and Penn Central taking, but the Ninth Circuit reversed, concluding that no reasonable jury could have found...

Read More

February 20th, 2021 — In News & Events

Destruction of Home During Police Enforcement Operations Not a Compensable Taking

Many people would assume that if a police department or swat team completely destroyed someone’s private residence during an operation to apprehend a fleeing suspect, particularly when that suspect did not have an ownership interest in the residence, the government would be responsible and liable for the destruction under the Fifth Amendment “takings clause” of the United States Constitution. But in two recent court decisions, one from Colorado decided...

Read More

February 17th, 2021 — In News & Events

Condemnor’s Quick Take Powers Require That Owner Receive Preliminary Compensation Offer

A recent Supreme Court decision out of Massachusetts illustrates the need to make sure a property owner receives what is deemed preliminary compensation (referred to in the opinion as the “pro tanto payment”) when a condemnor exercises its quick take powers to acquire and take control of an owner’s property before the condemnation action is completed and before the final determination of just compensation has been made. Indeed, the...

Read More

February 17th, 2021 — In OCA Blog

Considering the Condemnation of Golf Course Land or Golf Facilities-Not So Fast

OCA’s New York member Michael Rikon writes in his Bulldozers at Your DoorStep Blog about the hazards and risks associated with a condemnor seeking to acquire a golf course or lands associated with a golf facility by eminent domain main. “Not so fast,” Mike advises. Before deciding that such actions are a good idea, the condemnor might wish to critically analyze the concept of highest and best use. To...

Read More

February 9th, 2021 — In News & Events

New Jersey Eminent Domain Case Involving PennEast Pipeline Heading to U.S. Supreme Court

The U.S. Supreme Court announced on Feb. 3rd that it would hear the appeal on an eminent domain case involving PennEast Pipeline Co.’s efforts to build a 120-mile, 36-in. natural gas pipeline across open space and public lands preserved by the State of New Jersey for recreation, conservation and agriculture purposes. The Federal Energy Regulatory Commission (FERC) approved the project in January 2018. However, the 3rd U.S. Circuit Court of...

Read More